NonProfit News Excerpts (for release Sept 19)-Comments Tom Donahoe

Tell us how you became involved in Governance and guiding Outsourced CIO searches?

As an Executive Director of a Foundation, I personally directed a couple of outsourced CIO searches. The searches were both direct searches as well as searches conducted via an outsourced CIO search provider that the Foundation retained. This provided me direct experience with both approaches. The insights garnered from engaging directly in the step-bystep helps guide me as a search provider. Boards often need objective, independent guidance that help them optimize their investment decisions. These insights help animate our approach to achieving a successful OCIO search outcome for every client.

What is the typical catalyst for an Outsourced CIO search?

Board and Investment committee members are realizing that they just can’t do it themselves, they don’t have the bandwidth. There are many talented people on the committees and boards, but you only have a certain amount of a governance budget, i.e. the time and focus to fulfill your fiduciary duty. If the committee members quit their day jobs, they would certainly be able to undertake a full-blown search by themselves. But they realize that they can’t quit their day jobs, they meet 4X a year, and they can’t respond as nimbly as a fiduciary as they would like.

Any general observations on the search process itself?

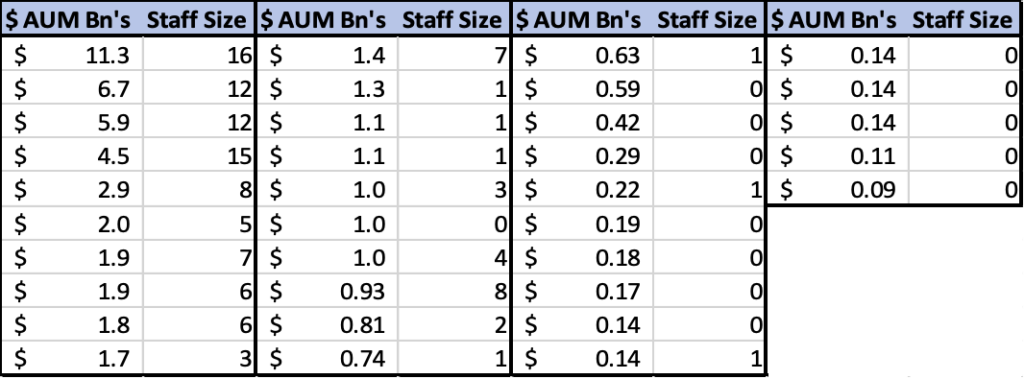

A proper search effectively creates a long-term investment partnership for your client. We are trying to really understand the board, its investment philosophy and their specific goals and needs. We engage Board members directly and work with them to verbalize and document what their ideal would be. We then use their guidance to filter through the 70+ OCIO firms with a national reach (and regionals as well) to distill those providers to a group of five to 10 potential finalists. These are the providers who can do what is required, will align with the board’s goals, approach, and personality, and are not conflicted in any manner.

We work directly with committee members to review each potential provider from the filtered list. We understand what each firm offers, who could be an excellent match and who would work well with the committee to meet its needs and goals over any time horizon. The ideal outcome is that 5+ years in the future, the committee remains satisfied with the same outsourced CIO provider. Excellent performance helps but also the goals/philosophies remain well aligned.

When a firm is awarded the charge to become the outsourced CIO provider for an institution, we

are very much involved in the transition process. We continue our involvement over the first few quarterly meetings to monitor and make sure things are going the way they should and ensure assets were transferred properly. After a period of time, with the investment committee’s consent, we then step away because if we’ve done our job, the committee and provider should be well in sync with each other. There is a trend now, after a period of 3 to 5 years, for the endowment/foundation to request a formalized review of the OCIO provider. That can be done by the firm who originally did the search or alternatively by a different firm. It is an excellent fiduciary discipline.

Comments about fees…

There has been significant fee compression over the last several years. You’ve likely seen it in your own personal Vanguard or Fidelity account and the same thing is happening in the Outsourced CIO space as well. I believe that even if you do not perform a formal five-year review of you OCIO provider, you are well advised to checkup on fees periodically and what’s being charged on an annual basis. It is simply a prudent fiduciary discipline.

On the size and growth of the space…

Surveys often report $1.1 trillion in OCIO assets, others $1.4 trillion. Most surveys do indicate that the growth rate is slowing from the high teens to high single digits growth p.a. The OCIO model is satisfying a real need in the marketplace and fiduciaries are realizing that an Outsourced CIO provider can help compensate for the deficiencies in the governance budget.

Asset Transition between Providers

There is an important issue that I would like to surface and that is management of asset transition. As soon as you give notice to your current OCIO provider, saying you’re changing OCIO’s, it’s typically “pencils down” by the incumbent provider. They will respond to any questions you have, but there is no providing of new information and it’s not clear if portfolio rebalancing would occur during this interim period. From the old OCIO’s vantage point, they are now going to wait to hear how and when to transfer assets.

The transition period can be delayed or extended simply because the Investment Committee is organizing itself. During the transition process there can be slippage. That slippage could be 30 basis points on your entire portfolio, or it could be conceivably as much as 70 or 80 basis points when things are not going well. That is many multiples of the cost of doing a search itself.

When non-profits do an Outsourced CIO search, they don’t know the backstory for every organization. We differentiate ourselves in our intimate knowledge of these firms, who is in the driver’s seat, how long they are going to be there, what changes at the firm have occurred, and what are their motivations. We incorporate these insights in our conversations with the board so they best understand what each firm has to offer and to fully inform their decision making.

Why don’t we become an Outsourced CIO?

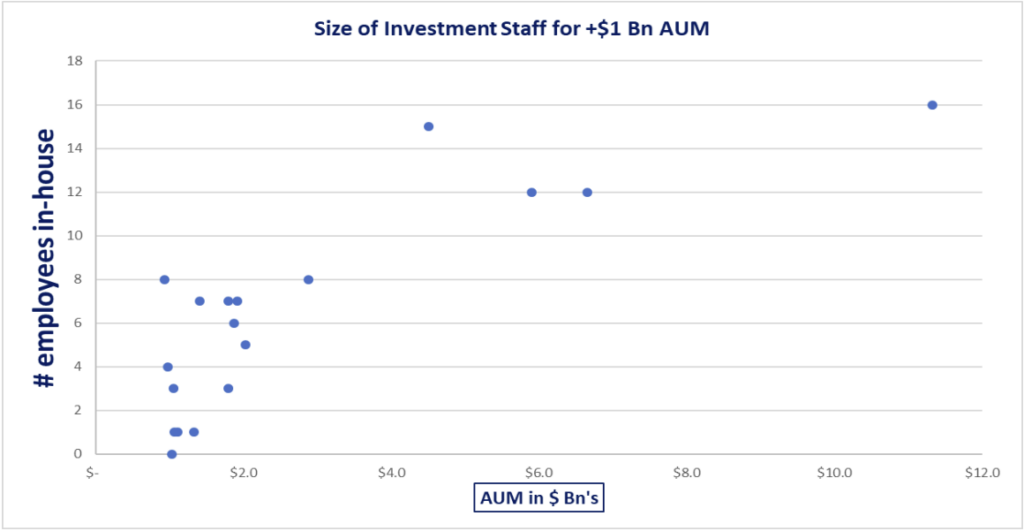

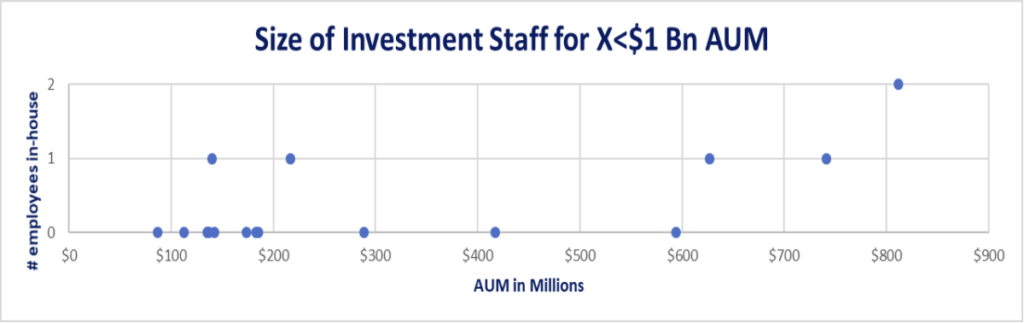

To provide added value as an investment manager, you need a critical mass to properly understand and monitor all the asset classes and best serve your client. There are great OCIO providers out there and we view our mission as achieving the best long-term fit for each of the non-profit and family office clients that we serve. Besides, we enjoy doing the searches, we enjoy the analysis, and we enjoy asking the questions and parsing out the answers. There is no better experience that matching a client with a well-suited OCIO provider who can provide the added value and support that our client needs and deserves.