WSJ: “Why Charities Have Been Such Bad Investors” – A Reasoned Response

An important new study of Endowment Investment Performance was released in Nov. 2018. Its two immediate lessons are: Don’t believe what you read about the “success” of large endowments’ strategies, and don’t trust self-reported performance numbers!

The authors found four key conclusions:

- Smaller endowments convincingly outperformed larger endowments in 2009-2016–This observation runs counter to the widely-held belief that sophisticated private strategies of larger endowments create an insurmountable advantage over smaller endowments.

- Actual IRS reported numbers fall well short of self-reported numbers in industry surveys–this observation creates broad questions about the integrity of data that is self-reported in compiling the NACUBO return benchmarks.

- “Investment wisdom of top universities is largely a myth” 2

- Higher fee investments have resulted in higher fees paid.

Smaller endowments have shown that with focus, proper dedication of internal resources, and intelligent outside advisory assistance, they can retain control over their endowments and get to a better investment destination.

When you get past the WSJ’s hyperbolic [click-bait] title, you’ll find a quite thoughtful study was performed on Endowment investment returns. The study finds “non-profits returned an average of 6.65% annually, even below [long -term] Treasuries” for the period 2009-16.

The study (first release) was created by two professors, one from Georgetown and the other from NYU. 3 The survey is important because of its large scale, 28,000 institutions. It’s based on actual IRS filings from 2009-16. Using submitted tax filings reveals dramatically less flattering results as compared to the self-reported returns of Endowments that form the basis of innumerable past industry surveys.

This response will provide you with the following:

a) A summary of the key conclusions of the professors’ work

b) Recommendations as to how the professors can strengthen/qualify their arguments.

c) Recommendations of additional cohorts and displays that will provide clarity for readers

While we feel that the professors arrived at quite logical conclusions, some of these are somewhat overstated. This weakens the persuasiveness and distracts from the overall usefulness of their study. While we are comfortable with the direction of the study’s findings, the methodology should be changed to better conform to actual investment industry practice. It remains an important study but is hampered, in its current version, by material over simplifications.

a) The study’s key conclusions (as quoted in the paper’s Abstract) are as follows:

- “Endowments badly underperform market benchmarks”

- “Smaller endowments perform better than larger ones”

- “Higher education endowments, the majority of the $700 Bn asset class, do significantly worse than funds in other sectors”

- The study finds mean returns of 6.65%, Long Term Treasuries 7.96% and US Equity 13.7% 4

We believe that these specific points are somewhat overstated. By revising some of the methodological approaches, the arguments can be made more compelling. By better reflecting actual market practices, the endowments’ underperformance will remain material but not as dramatic as the WSJ headlines would imply.

b) Recommendations to strengthen or qualify the study’s methods and conclusions:

- 2009-2016 return period covers only a rising market cycle not a complete cycle -comments Model portfolio composition should use the global equity ACWI and NOT the US S&P500.

- Observations on calculating approximate returns from the 990 tax filings.

- Present additional return tables that focus on the returns of Yale and other “Ivies”

- Competency of Investment Committees requires additional background and context

- High fees paid versus returns achieved should trigger review of structural governance conflicts

1) 2009-2016 RETURN PERIOD COVERS ONLY A RISING MARKET CYCLE

The time period was determined by the electronic data that the IRS released by court order. 5 It happens to cover the years of 2009-2016, which you, gentle reader, know coincided with a sustained bull market in US equity markets.

We must accept the time period selected. Going back further in history likely would mean that the IRS data would be both less accessible and less reliable. Moreover, only with the GFC (’07-’09) did many auditors prioritize testing of valuations of illiquid/structured investments. (Older data is more tenuous.) When we layer in a static asset allocation, as did the authors, we are dealing more in the academic world as opposed to a diversified portfolio that gets rebalanced over time. (see comments below.)

2) MODEL PORTFOLIO COMPOSITION – USE ACWI NOT S&P 500

The study used a model portfolio with the S&P500 Index as the exclusive equity index. This favors large cap and tech names, so growth and momentum strategies are rewarded. It also evidences a “home country” bias (USA) although more than 2/3 rd’s of world equity market values are outside the USA.

Moreover, endowment portfolios are built for perpetuity. So, a material percentage of the typical portfolio provides diversification and performance when equity markets are not performing as well. Finally, it is a static allocation that ignores diversification goals and simply cannot directly measure portfolio re-balancing effects.

The 60% S&P/40% Bond mix performed well. In fact, the Fed kept rates low (artificially) and engaged in quantitative easing. This also helped reduced volatility to quite low levels. In early 2019, we are only now observing more realistic levels of implied volatility in the markets. So, 2009-16 was a unique time.

To improve the analysis, we would recommend that reference index be recalculated using the MSCI ACWI in order to eliminate the home country bias as well as to better reflect a common benchmark used by Endowments. Certainly, since we do not have access to reliable, detailed asset allocation information (nothing GIPS compliant here but demonstrably more reliable than self-reported returns in industry surveys), so there are real data limits to the IRS numbers. Moreover, Fiscal year-end positions (on Form 990) could vary materially from those held intra-year.

3) CALCULATING APPROXIMATE RETURNS FROM THE 990 TAX FORM

The reality is that the 990 does not provide return numbers directly. Even if they did, one would have to determine whether it was a rigorous calculation. E.g. similar to a GIPS compliant standard. Given those impediments, the indirect calculations laid out in the paper make sense, given the limited information available. We have reviewed the methodology with auditors who specialize in the E and F space and they agree that calculating returns as outlined in the professors’ paper is a sound and highly defensible approach.

4) PRESENT TABLES TO HIGHLIGHT THE RETURNS OF YALE AND OTHER “IVIES”

For additional granularity, we recommend the authors add the following two tables to buttress their

conclusions:

- YALE by itself

- CHORT of all 8 Ivies Schools (and perhaps also just the 7 Ivies alone?)The existing cohort of top 20 (or so) Endowments while helpful, as presented, is subject to change given its link to US News rankings. Moreover, there is a dramatic difference in endowment size between number 20 ranked and the top 4 or 5 of the US News cohort.

Another benefit would be to highlight the difference between self-reported versus actual IRS 990 numbers. Finally, so much past ink has been spilled in tracking the Ivies’ performance that industry participants (as well as Boards) are very attuned to the Ivies’ performance returns and it is what the report’s audience would be quite keen to know.

5) IC GOVERNANCE ISSUES AS TO COMPETENCY

Staff/OCIO/Investment Specialists/Investment Committee (or a combination) could be the parties directing the actual asset allocations within an Endowment. Typically, there is no specific required background required to be an investment committee member. (Contrast with Audit Committees where the Chair is typically a CPA holder.) Given Board term limits, the composition of the Investment Committee could have changed materially during the study period.

There has been an explosion in the outsourced investment office model. Some surveys indicate that as much as 50% of Endowments between $25 mm to $500 mm in AUM have now adopted the outsourced model for part or all their total endowment management. Indeed, the actual investment decision-making process could have changed as well.

Many colleges allow Trustees to serve 7 – 9 years, some longer. This study covers 8 years and assuming staggered terms, well over ½ of the Investment Committee members could have changed. We do concede that the role of IC Chair does tends to be a role is held for an extended number of years. The more the actual IC compositions have changed during the study, the stronger is the authors’ argument that there is a material structural governance issue amongst Endowments.

6) HIGH FEES PAID FOR INVESTMENT ADVICE SHOULD TRIGGER DEEPER ANALYSIS

The paper’s authors point generally to high fees paid in some instances. This can occur when investments are directed specifically to high fee alternate investments. Many IC members work in the investment sector as professionals which the report points out is especially true for Endowments based close to financial centers. There is a common conceit to believe that since you do it for a living, you know better than your peers how it should be done. There are additional sources of dysfunction on IC committees (see Vanguard website for extensive research on the topic as well as recommended best practices.)

There is always the temptation to direct business to specific alternative investments or hedge funds that will provide additional fee income for those favored funds. One also has the issue of co-investments as well as excess business holdings where investments are concentrated in higher risk biotech start-ups or venture capital positions. That is beyond the scope of the authors’ paper and the writer mentions these situations simply to highlight their existence and potential impact on the returns that were observed in the study.

In summary, the study provides useful insight into a broad segment of the endowment investment market. The paper highlights some of the data deficiencies and approximations that exist given the crude structure of the IRS 990. There is less uniformity in reporting compared to other asset managers.

Given these material handicaps, the authors do succeed in shining much needed light into the vaguer corners of the endowment investment world. With the integration of the 6 recommended observations that are proposed, and the additional charts/tables as outlined, an updated version will attract more readers and advance the insights achieved by this study.

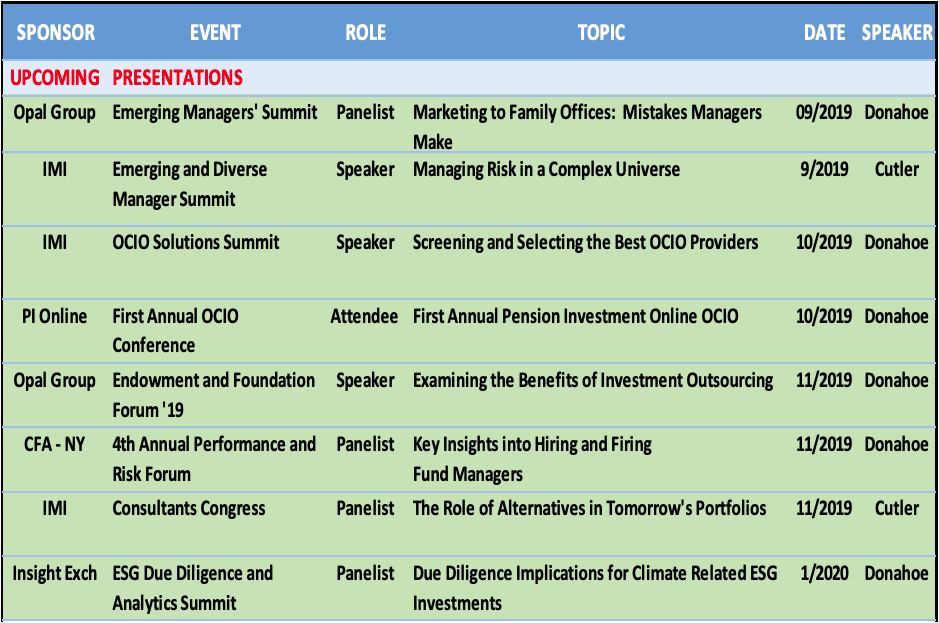

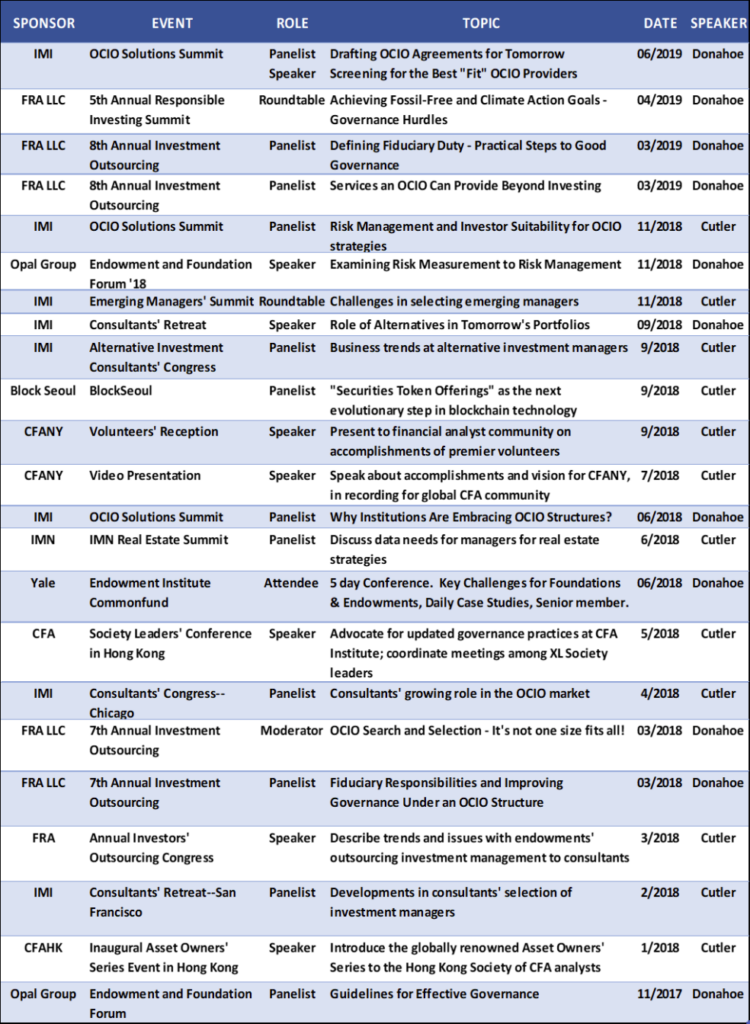

Want to learn more? Please contact Chris Cutler or Tom Donahoe.

Footnotes:

- Jason Zweig. “Why Charities Have Been Such Bad Investors.” Wall Street Journal 11/27/2018.

https://www.wsj.com/articles/why-charities-do-goodbut-not-wellwith-your-money-1543402800

- Sandeep Dahiya, David Yermack. “Investment Returns and Distribution Policies of Non-Profit Endowment Funds.”

Report 11/27/2018. Page 18 OR https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3291117

- Ibid.

- Ibid., Page 3

- Ibid., Page 4

File Name — C: Governance – A Study of Endowment Returns: A Reasoned Response-