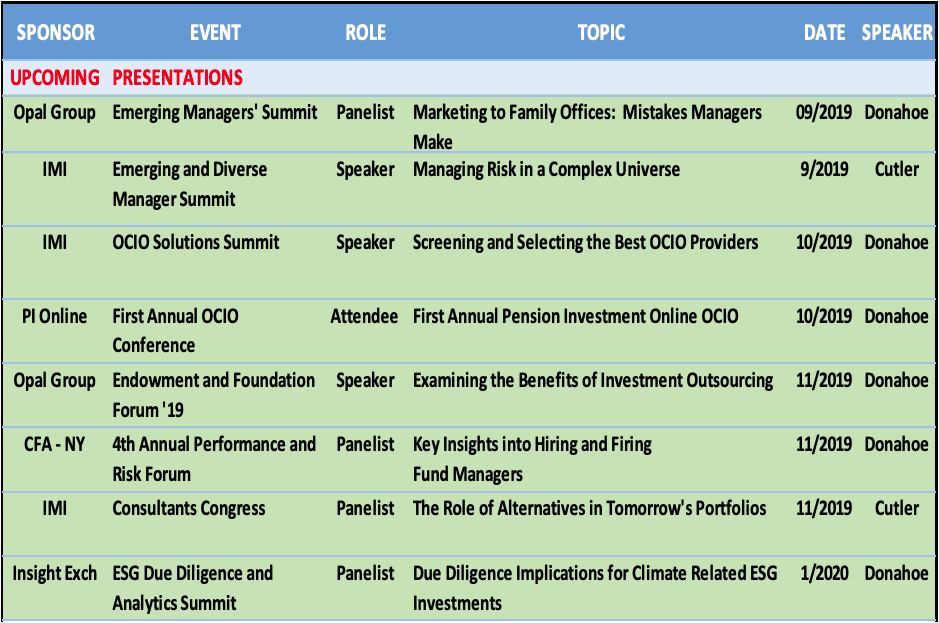

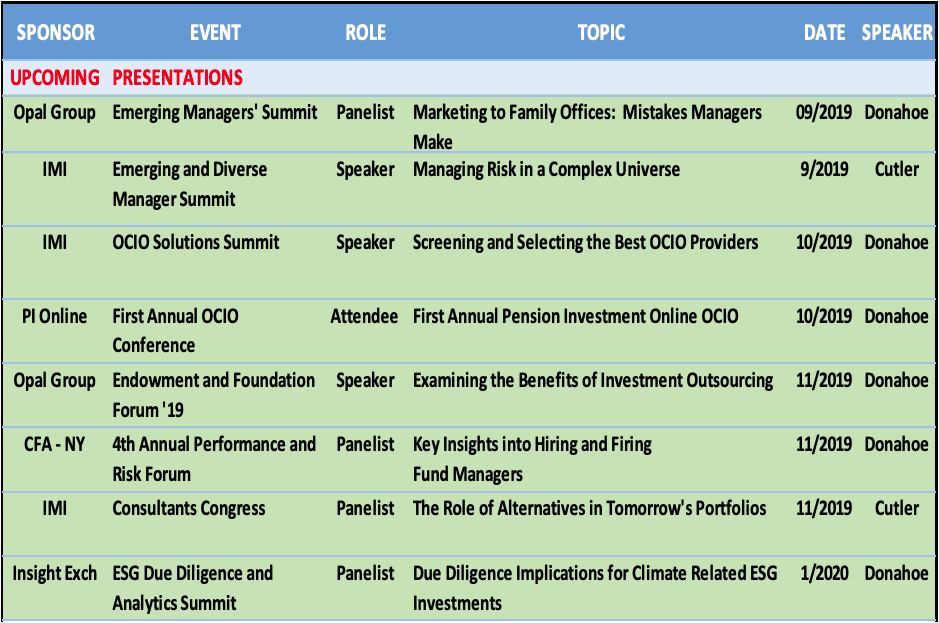

Manager Analysis Services Presentations

THOUGHT LEADERSHIP – INDUSTRY SPEAKING ENGAGEMENTS

PAST PRESENTATIONS

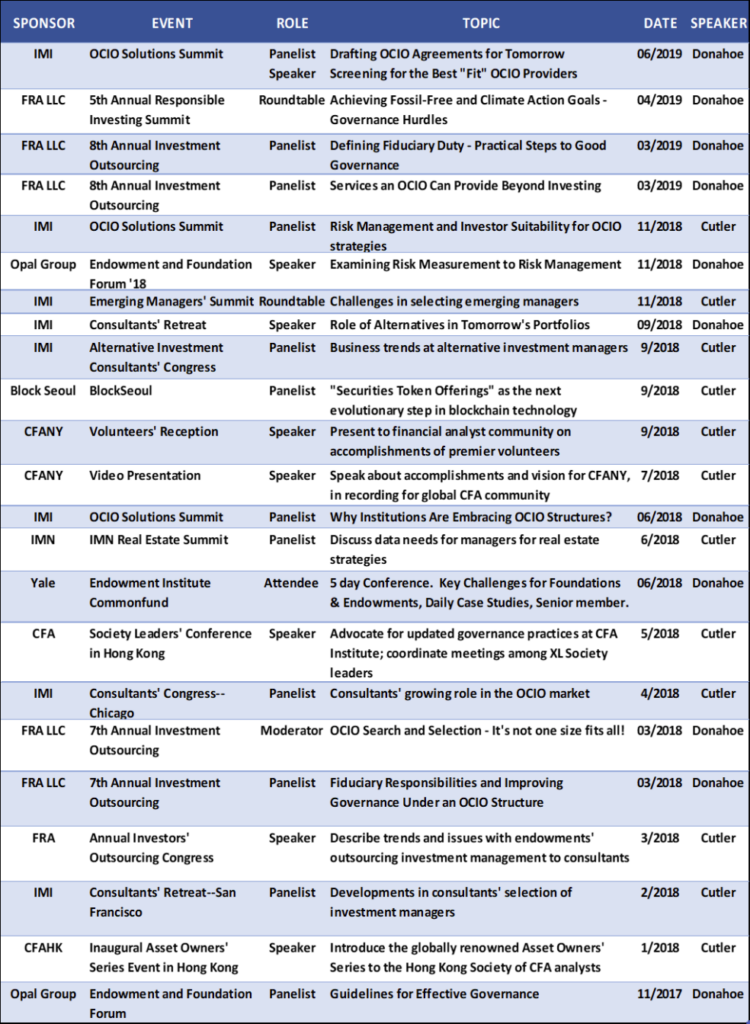

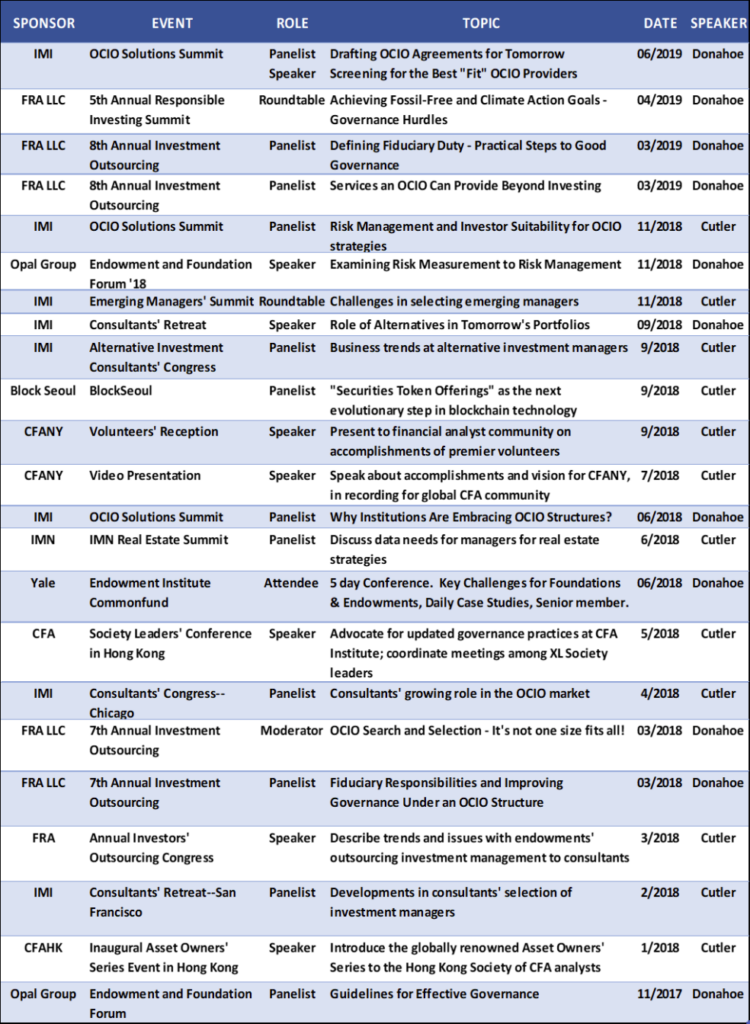

INDUSTRY SPEAKING ENGAGEMENTS

Manager Analysis Services Presentations

THOUGHT LEADERSHIP – INDUSTRY SPEAKING ENGAGEMENTS

FundFire, by Aziza Kasumov

Institutional investors are increasingly paying attention to how they might unwind their outsourced CIO (OCIO) relationship – even as they’re just getting started with a new provider. The heightened focus comes after a generation of early OCIO adopters realized that it can take years to get out of some holdings, and they can still incur high fees for “legacy funds” that their old OCIO administered, search consultants tell FundFire.

“It’s very easy to sign up a new OCIO, but the exit strategy is a very critical deficiency,” Tom Donahoe, Managing Director of OCIO search and governance at Manager Analysis Services, said at an OCIO Solutions Summit last week Donahoe said that often institutional investors don’t discuss exit language “when they jump into an OCIO agreement.” But once a provider is terminated, it’s “pencils down.” That creates “slippage where you can lose real value over a two or three week transition period simply because people are taking their eye off the ball,” Donahoe explained. (shortened for brevity) (6/17/19)

Manager Analysis Services’ (MAS) Emerging Manager selection process has been distilled from hundreds of searches conducted globally across asset classes and investment strategies. MAS’s EM searches have the following parameters: Manager AUM of no more than $ 2 billion at time of hire and include minority, women, veterans and disability certified managers. Our process focuses on 4 key areas of analysis:

MAS carries out a comprehensive line of inquiry which includes:

MAS believes picking the right strategy is as important as picking the right manager, diligence involves:

MAS prefers managers who exhibit strong portfolio construction skills with respect to risk management. Diligence focuses on:

MAS’s objective is to understand a manager’s unique business risks which include operational, financial and personnel not only at time of initial investment but on an ongoing basis. MAS reviews:

Manager diligence lies at the heart of MAS’s consulting business, and MAS’s principals have reviewed

over 2,000 managers since 2003. Our experience includes manager diligence in both traditional and

alternative asset classes. We have evaluated core and specialist managers who invest with a specific

focus on sector, industry, market cap or geographic factors. We help investors source, analyze, assess,

invest in, monitor, and terminate investments in managers.

Want to learn more? Please contact Chris Cutler, Tom Donahoe or Safia Mehta at 917 287 9551.

Many Family Offices place a premium on discretion and refrain from engaging expertise that does not emanate from a “close(d) circle” of advisers. The downside to this approach is that a Family Office exposes itself to the pernicious practice of being exploited, which occurs all too frequently across the wealth management industry. Families who are most comfortable with their “close(d) circle” of advisers are often the most exposed. Few cases are as severe as the Leslie Wexner case or the myriad losses from Madoff. The most frequent cases that we encounter involve excessive fees or efforts to misdirect trust proceeds.

The parties involved with these activities may not be the usual suspects. We have seen service providers play a material role in jeopardizing families’ legacies. Some examples include:

It is critical that a Family Office obtain a clear understanding that their fees are reasonable and that they obtain high quality, unconflicted services. Significant conflicts of interest are often overlooked or missed, not only at brokerage firms and private banks, but also among law firms, accounting firms, brokerage firms, and private banks.

Families face this predicament since they lead busy lives and their expertise often lies in running businesses outside the realm of institutional investing. Even when a family member does understand financial markets, the breadth and depth of challenges remain substantial. Too often, navigating institutional investing strategies distills down to over-reliance on a narrow set of trusted relationships, without properly assessing the performance of legal, tax, and accounting advisers that a family may utilize.

Manager Analysis can help families tap into skilled expertise that could help them ensure fair treatment, enhance their service levels, and reduce fees. Given our extensive experience assessing fee levels, commitment terms, portfolio construction, and overall quality of investment managers and service providers, we can address those factors that create the greatest vulnerabilities for families, while providing timely and thoughtful counsel to your family.

Performing a comprehensive review of your portfolios typically leads to enhanced communication with all service providers, stronger levels of support, potential material changes in investment managers (as needed) and improved and timely responsiveness to portfolio changes and market conditions.

Want to learn more? Please contact Chris Cutler, Tom Donahoe or Safia Mehta at 917 287 9551.

© 2019 MAS, LLC

By Alyson Velati | 1/30/18

“…A CIO can essentially help the committee interpret and understand what their OCIO is advising for the portfolio,” Chris Cutler says.

“Cost is certainly one important ingredient people care about, which is one of the advantages of having an in-house investment staff,” says Chris Cutler, president of Manager Analysis Services. “But, I’m seeing a dynamic shift where some boards don’t really have the governance capital to be able to administer decisions in a way as it should be done, so they’re making the switch to an OCIO.”

By Lydia Tomkiw | 12/5/18

…Watch lists can have a ripple effect and cause other investors in funds to reexamine their own investment decisions, says Chris Cutler, president of Manager Analysis Services. “It will cause other allocators to question their own allocations to those managers. It’s not positive publicity,” he says.

By Danielle Verbrigghe | 11/9/18

… “Every Rocaton client has a fiduciary duty to review their appointment of Rocaton,” said Christopher Cutler, founder of investment consulting firm Manager Analysis Services, in an email.

By Alyson Velati | 10/18/18

…“They want the consultant to travel 12 times per year, cover all expenses, perform a ton of work that is unique to Tampa and review alternative investment strategies,” says Christopher Cutler, president of Manager Analysis Services, via email. “They are getting what they pay for.”

By Mariah Summers | 10/17/18

…But the 10-largest macro funds have fared a bit better, returning .90% so far this year, though they saw performance of -1.46% in the third quarter, compared to -.90% among all macro funds.

This trend is likely to spell trouble for macro funds of all sizes if it continues, says Christopher Cutler, president of Manager Analysis Services.

“There is a high risk of disappointment if returns do not improve,” Cutler says. “I was speaking with one very large institutional allocator recently that still is a very prominent hedge fund investor. His organization is likely to make large redemptions and greatly reduce the share of hedge funds in their portfolio over the next year.”

That puts pressure on macro funds, he says.

“I would like for macro hedge funds to demonstrate sufficiently improved results to sustain the recent rally in allocations, but hedge funds seem to be slipping behind private equity and ‘real assets’ investing as perceived ways to diversify institutional portfolios,” Cutler says.

But for now, macro managers may have a short window still to work out performance issues in the near term as investor fears of a sell-off intensify.

By Alyson Velati | 7/3/18

…Typically, investment consultants already include “pricing guidance” in their fees, says Chris Cutler, president of Manager Analysis Services, a firm that provides manager diligence and governance review services for institutional investors, via email.