LinkedIn, by Chris Cutler – DEC 2022

You Can Meet Interesting People in Crypto

While managing my own investment due diligence firm for the last 20 years, I also probe ahead to understand the next great investment themes. The ever-expanding crypto market was an obvious potential candidate from 2016 to 2019.

My initial read of this market was that the hype about replacing “fiat currencies” with cryptocurrencies detracted from the true opportunity: accessing incredibly cheap venture capital money.

How so? Consider the investors’ terms for investing in a cryptocurrency vehicle, of which over 20,000 have been launched. Investors typically receive no explicit rights to earnings, distributions, voting, nor other investor protections. They profit only if later investors are willing to pay higher than the original purchase price. In addition to these deficiencies, the regulators [particularly the CFTC] assert jurisdiction, but its oversight has proven ineffectual.

I have reviewed many venture LPs and I have never seen such unattractive investor terms in the mainstream venture markets. Cheap capital doesn’t get any cheaper than in crypto! However, that’s not to say all crypto ventures are flawed. Some of the capital from crypto launches have funded new and interesting technologies, and some excellent crypto-related businesses. Along with a handful of crypto enthusiasts, I wrote a white paper to create just such an innovative technology in the field of payments systems. However, after almost two years probing the crypto community, I decided the crypto landscape was too squirrelly for me to launch a venture or concentrate my business. Here’s why.

Venture Investing as a Reference Point for Crypto Investing

Venture Capital is a useful reference point when thinking about crypto market investments, since venture is like a midpoint on the diligence continuum between crypto and private equity investing. Venture investors incur risks that would be simply unacceptable to private equity, hedge fund, or traditional investors, yet venture investing can be tremendously successful. Venture managers seek to back exceptionally talented venture founders, from the creation of their nascent companies until their ultimate IPO or sale.

On the other hand, private equity managers will focus on existing businesses, conducting much more rigorous reviews of assets, earnings, management, and operations of the companies they purchase. Venture diligence practices would never work in private equity markets, yet both markets provide excellent investment opportunities.

In our business we see many talented venture managers–reviewing venture managers is one of the most interesting activities in our diligence business. We have also seen many problems. In the public arena, we are truly puzzled by Andreeson Horowitz’s backing of WeWorks founder Adam Neumann, for example.

Privately, we have rejected about half of earlier-stage venture managers brought to us and already reviewed by our talented institutional-investor clients, often because our additional digging found the venture managers misled about their backgrounds and track records in ways that are far more egregious than anything we’ve seen recently from private equity or hedge fund managers.

Crypto vs Venture

The crypto market’s key challenge is to rise first to the level of venture investing, and then to institutionalize the marketplace. There are big hurdles, and they make venture investing look easy. Crypto ventures have even less regulation than venture capital managers. Unlike in mainstream venture, crypto ventures are rarely audited, and they often do not have effective independent board directors or independent controllers. Insider trading is common, and usually no separation exists between executives and control functions.

However, crypto’s worst enemy may be the unbridled arrogance of a full generation of young crypto programmers who actually believe their work displaces principles developed over centuries about banking systems, currencies, and macroeconomic principles. Risk managers? Credit risk controls? AML controls?

Audits? Who needs them?

There are many morals to the unfolding saga of FTX, but rather than list them, we’ll just provide a sort of portrait-guide to some of the recently noted players in crypto space:

Alex Mashinsky – Founder of Celsius Network, a sort of crypto prime broker funded by crypto depositors that filed for bankruptcy in July. Banks? Regulators? Fiat currencies? Who needs them?

Steven Narayoff – Attorney charged with trying to extort additional large payments from cryptocurrency issuer-clients. Partner pled guilty. Narayoff’s pleading not guilty.

Jack Abramoff – Once one of Washington’s most influential lobbyists, just the man to trust to start an AML – compliant version of bitcoin?

SBF – FTX acted as a “custodian” but could not withstand the temptation to gamble clients’ assets.

CZ – No public audits, no obvious controls, no regulators, law enforcement interest in his activities, what could possibly go wrong?

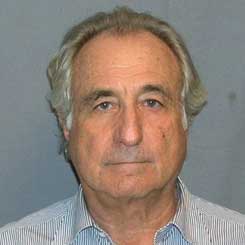

Needs no explanation.

Conclusion

Investment conviction is not a substitute for independent diligence. Nothing in crypto negates the importance of having independent custodians to hold assets, independent diligence experts, independent administrators, independent attorneys, independent auditors, independent valuation, reputable international jurisdictions, and sensible investment agreements. Investors should be wary if they are solely relying on white papers or technology without the benefit of at least venture capital investment infrastructure.

You should ensure that you have the level of protection from your diligence process to evidence that you fulfill the duties that you as a fiduciary are charged with fulfilling. Even the smartest institutional investors face challenges in venture investing, and we have helped our clients focus on the more promising ventures and avoid catastrophic mistakes.

Chris Cutler CFA

President

Manager Analysis Services, LLC

cutler@manageranalysis.com

December 16, 2022